NYer

Veteran

- Joined

- Jun 4, 2010

- Messages

- 4,167

- Reaction score

- 905

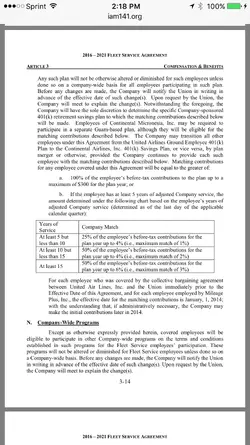

Tim, I too have posted many times in the past about how these pension plans are going by the waste side one at a time. UPS bought out all their pensions to get the employees out of a failing system. IAM has made one or two cuts in the past (may not have been this IAM's pension) and I believe those were on the retirees. There is currently several pensions on the chopping blocks getting ready to get frozen or at least will be chopped in half and in some cases some retirees will see up to a 33% cut on payouts. All these are documented cases. With the millions upon millions of pension workers laid off, fired, or just leaving their work the pensions are slowly dying away from the lack of participants. After 9-11 the airline industry lost hundreds of thousands of pension workers that were no longer participating once they were laid off or riffed, not to mention the many, many other workers that were released after 9-11. I can't believe the IAM side is still trying to push this pension fund into the AA'ers side. I too would much rather see you guys freeze the existing and get a heftier match in the 401K and other retire accounts increased. Plus the pensions die if the person dies, whereas the 401K can very easily out live the participant and be passed onto family, not so with the pensions. For that alone should be enough. They will have to cut the pensions again in the future, that's a fact...

401K's are by no means a safe vehicle for retirement. When the market is going up the returns are there but in downturns like we had in the 80's, the 90's and the 2000's decimated many 401K's accounts.

The key to long term investment is diversification. If given a choice to participate in a pension while also contributing to a 401K,most should take that choice.

Many of us in LAA were lucky we had a pension plan but we also took advantage of the 401K. When the Pension Plan was frozen it forced many of us with our eggs in one basket (the pension) to start a 401K from scratch.

10 or 15 years is not a sufficient time to build a large enough nest egg to retire on. However, those that started from scratch have the benefit of supplementing their 401K withdrawals with their frozen pension payout.

That diversification is what can protect us from either a pension meltdown or an overall economic meltdown.

Don't believe anyone will be forced into the IAM plan but to discount a voluntary participation could be self destructive.