He looks like David Cassidy a little the weez was a big fan a big fan

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

American Airlines and Labor Negotiations

- Thread starter Buck

- Start date

- Status

- Not open for further replies.

So you think the iam will increase membership and more employers will agree to join the plan.Id like go see the charts showing an increase in iam membership.I don’t get how you’re saying that the IAMPF doesn’t have the ability to add new Membership? There’s strong forward looking demand for growth within the Aerospace market in the next few decades as Human population (cattle) continues to grow.

But if the fund does show signs of further trouble restricting the start of collecting till one is 65 or reducing the percentage that can be drawn pre 65 (60 to 65) is one solution. Barring of course if someone can claim a personal medical hardship collection with no benefit loss.

WeAAsles

Veteran

- Joined

- Oct 20, 2007

- Messages

- 24,117

- Reaction score

- 5,269

they have a very difficult time getting new employers in it due to the increased risk to employers.

What risk to employers? There is no employer responsibility to make up for shortfalls if the fund starts to degrade.

Now on the other hand there is that responsibility with my DBP with LAA. (AMR)

WeAAsles

Veteran

- Joined

- Oct 20, 2007

- Messages

- 24,117

- Reaction score

- 5,269

So you think the iam will increase membership and more employers will agree to join the plan.Id like go see the charts showing an increase in iam membership.

Irrelevant to me if they do or they don’t. It’s your albatross as you view it, not mine.

Like I said. I don’t think I’m going to have the option to consider it anyway?

But if the IAM does trade it away for a 401K program, I think you should get the maximum value you can for the exchange.

WeAAsles

Veteran

- Joined

- Oct 20, 2007

- Messages

- 24,117

- Reaction score

- 5,269

Any chance you may want to post a legible photocopy of that summary sheet so we can read it for ourselves?

Members want to know.

PIEDMONT784

Veteran

- Joined

- Feb 3, 2018

- Messages

- 681

- Reaction score

- 41

About the same Josey Wales not gunning down that bounty hunter after telling him... "Dyin' aint much of a livin' boy"...Any chance you may want to post a legible photocopy of that summary sheet so we can read it for ourselves?

Members want to know.

WeAAsles

Veteran

- Joined

- Oct 20, 2007

- Messages

- 24,117

- Reaction score

- 5,269

About the same Josey Wales not gunning down that bounty hunter after telling him... "Dyin' aint much of a livin' boy"...

I’ll tell you PIEDMONT, just because of my insatiable curiosity alone I really would like to read that summary page of his?

Tim Nelson

Veteran

the employers fund it and pay an interest. Martinez and other unions went to capital hill to ask for the employers to pay more into the pbgc fund. This isnt funded by public funds.What risk to employers? There is no employer responsibility to make up for shortfalls if the fund starts to degrade.

Now on the other hand there is that responsibility with my DBP with LAA. (AMR)

Read united airlines annual report as well.

Tim Nelson

Veteran

+1WRONG

Tim Nelson

Veteran

i put it right in front of the camera in the video i posted. I also posted it here already. Kindly review. Not sure why we have to discuss this?Any chance you may want to post a legible photocopy of that summary sheet so we can read it for ourselves?

Members want to know.

2 years in pbi then down to mia.

Tim Nelson

Veteran

^^^This^^^Updated IAM Pension Information

The latest IAM Pension Fund Actuarial Valuation Report, as obtained by BABU. The following statistics and sicknesses were contained on the official documents (The Pension Administrator only provides this to members who request it)

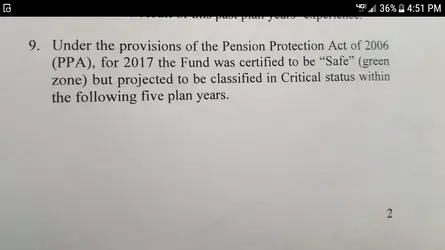

1. For the first time, The Official Actuarial states "the fund is projected to be classified in the Cricial status within the following five years." (Page 2)

...

2. For the first time in many years, the number of retirees exceeds the number of Actives. (actives 95,907, Pensioners and Beneficiaries 98,109. This is a 4% increase in retirees collecting from previous years. (

3. Pension benefits paid out increased from $626 million to $671 million.

4. Greatest % Age Bracker of actives: 55-59

5. Average age of actives, 49 (Page 25)

6. Investment Loss: $106 Million (Page 2)

7. Actuarial investment loss: $414. (Page 2)

8. Negative Net Cash Flow: $295 million

(Negative cash flow for each of the last 12 years, avg $180 million)

9. % Funded in each of last several years:

2010: 99%

2011: 106% (this was the year they slashed $2 billion of our benefits to get the plan funded)

2012: 104%

2013: 103%

2014: 102%

2015: 101%

2016 96%

2017: 92%

Within next 5 years, projected by the Official report to be in Critical Status. Expect another cut in benefits.

Yes you are.WRONG

We had guys out there collecting and were found out and payments were stopped.

Tim Nelson

Veteran

You know who started that "MWTK"?Any chance you may want to post a legible photocopy of that summary sheet so we can read it for ourselves?

Members want to know.

Here is the official report showing the critical projection. Didnt even say "endangered (80%<).

Attachments

WeAAsles

Veteran

- Joined

- Oct 20, 2007

- Messages

- 24,117

- Reaction score

- 5,269

Updated IAM Pension Information

The latest IAM Pension Fund Actuarial Valuation Report, as obtained by BABU. The following statistics and sicknesses were contained on the official documents (The Pension Administrator only provides this to members who request it)

1. For the first time, The Official Actuarial states "the fund is projected to be classified in the Cricial status within the following five years." (Page 2)

...

2. For the first time in many years, the number of retirees exceeds the number of Actives. (actives 95,907, Pensioners and Beneficiaries 98,109. This is a 4% increase in retirees collecting from previous years. (

3. Pension benefits paid out increased from $626 million to $671 million.

4. Greatest % Age Bracker of actives: 55-59

5. Average age of actives, 49 (Page 25)

6. Investment Loss: $106 Million (Page 2)

7. Actuarial investment loss: $414. (Page 2)

8. Negative Net Cash Flow: $295 million

(Negative cash flow for each of the last 12 years, avg $180 million)

9. % Funded in each of last several years:

2010: 99%

2011: 106% (this was the year they slashed $2 billion of our benefits to get the plan funded)

2012: 104%

2013: 103%

2014: 102%

2015: 101%

2016 96%

2017: 92%

Within next 5 years, projected by the Official report to be in Critical Status. Expect another cut in benefits.

^^^This^^^

Can I please see a photocopy of the document as my main interest is the comments you say they made here:

1. For the first time, The Official Actuarial states "the fund is projected to be classified in the Cricial status within the following five years." (Page 2)

“Within next 5 years, projected by the Official report to be in Critical Status. Expect another cut in benefits“

WeAAsles

Veteran

- Joined

- Oct 20, 2007

- Messages

- 24,117

- Reaction score

- 5,269

You know who started that "MWTK"?

Here is the official report showing the critical projection. Didnt even say "endangered (80%<).

I think I need to read a little more than just the part you took a picture of?

NYer tried to play the same trick on me with a portion of an E Mail exchange once too.

Last edited:

- Status

- Not open for further replies.

Similar threads

- Replies

- 1

- Views

- 1K