jimntx

Veteran

OK Donald you can go back to combing your coiffure now. I see that it takes very little to entertain you.Reeled me in another one!

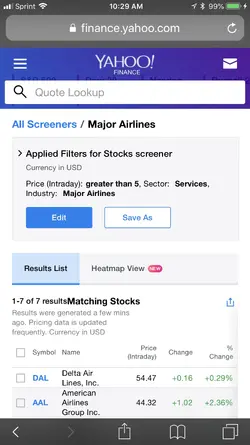

If you look at "AA and Labor Negotiations" #1931 you will find that I already discussed Warren Buffett and the fact He is a majority share holder in DELTA AIRLINES.