WeAAsles

Veteran

- Joined

- Oct 20, 2007

- Messages

- 27,272

- Reaction score

- 5,365

gulfcoast1,

IMO, there are 3 big hurdles:

1. Scope

2. Health Insurance

3. Pension/401K

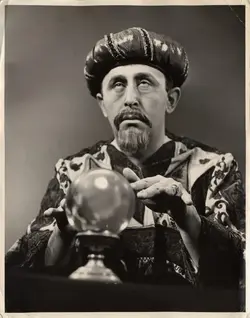

I believe based on the letter signed by Gless and Pantoja in 2014, that the pension is very important in these talks. When I walk my breakrooms, I have stated that I would personally be in favor of both the pension and 401K match. That seems to be fine with both the 401K preference crowd as well as the pension preference crowd. As CB stated a week ago or so, I worry about the pension. Also, I worry about the 401K. We are in an 8 year bull market, which is the 2nd longest bull market ever I believe. When the bull market ends, it's usually not pretty with 20% declines off previous highs. Give me a crystal ball and I can tell you which would be best moving forward. There are 5 weeks scheduled for negotiations through the end of July. IMO, there is a possibility we have a deal by then but of course that depends on the progress made on the 3 big hurdles mentioned above.

P. Rez

Good advice from the Oracle of Omaha if and or when that bubble does burst again. (They always do eventually)

https://finance.yahoo.com/news/warren-buffett-says-want-steady-130000688.html