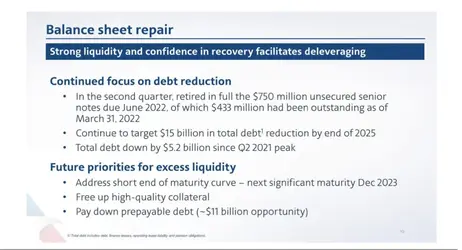

Holy crap guys. This is alarming, is it not? 75 Billion debt? Is this true?? If I remember correctly the last time they filed for BK they were a mere 32-35 Billion in debt. And now AA has a number (yes, more than a few) of law suits against them for many different reasons and from different entities, including the DOT, DOJ, and the suit on the NEA with JB that the Gov is suing over.

Just came across this article and was flabbergasted by how much debt AA has this time around (if all is true). Does this not put them at a 66%-75% chance of going BK again?? United at 52%, but has way more avenues they can go prior to hitting the BK button where AA does not any longer as they ate up all their options early on. I leave you all with the article below. Also don't forget the super increased pay for Pilots to keep flying at AA as well as at all the regional airlines that gets passed onto AA cost as well.

Prepare yourselves folks. It may never come to it, BUT, YOU never know, so prepare for the worse. Just like last time, NOBODY thought they would have filed for BK when they had all those BILIIONS 5-6 in cash and reserves last time, never say never, get prepared folks.

Just came across this article and was flabbergasted by how much debt AA has this time around (if all is true). Does this not put them at a 66%-75% chance of going BK again?? United at 52%, but has way more avenues they can go prior to hitting the BK button where AA does not any longer as they ate up all their options early on. I leave you all with the article below. Also don't forget the super increased pay for Pilots to keep flying at AA as well as at all the regional airlines that gets passed onto AA cost as well.

Prepare yourselves folks. It may never come to it, BUT, YOU never know, so prepare for the worse. Just like last time, NOBODY thought they would have filed for BK when they had all those BILIIONS 5-6 in cash and reserves last time, never say never, get prepared folks.