CremaDiLimone

Veteran

- Jun 8, 2016

- 1,817

- 154

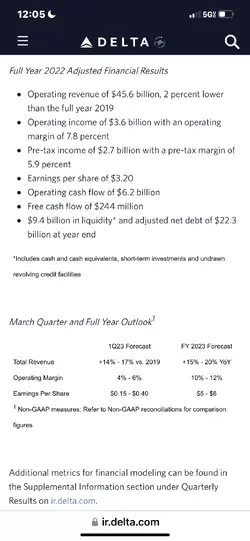

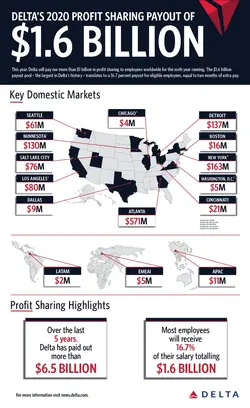

well, this has been discussed in the delta thread - so, we'll make a thread here. the fantastic news that the 2022 profit sharing year is based on dates april 1, 2022-march 31, 2023 is all the money.

i had personally based my predictions off of $1.8 billion in pre-tax for the last 3 quarters of 2022 and a break-even 1q 2023.

on tuesday, j p morgan held an airline investors' conference and this is what isom said:

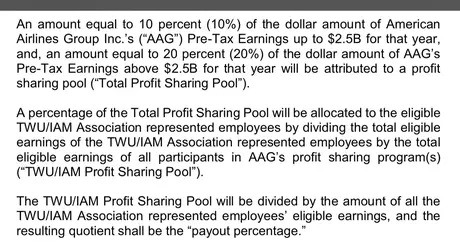

ok...so, isom said $2.4 billion in pre-tax profits for the last 3 quarters of 2022. excellent. if so, an additional $60 million in the kitty - bumps up the clean average to $8k per, for 30,000 assoc. employees. this is not the distribution formula, but it gives us an idea of what is to come.

could get better...aa forecast for 1q 2023 jetfuel:

jet fuel has been lower in the past month than forecasted - albeit, jan was higher, if i remember correctly. oil went down significantly the past few days due to the banking issues and will likely be lower the rest of march.

what i'm getting at is if isom's $2.4 billion in pre-tax profits is correct and aa makes a humble $101 million pre-tax profit in 1 quarter 2023, then the kitty doubles, from 10% of all pre-tax profits to 20%.

weaasles, i throw bags for a living. use your union connections to verify this scenario.

it could get much better than my optimistic prediction.

i had personally based my predictions off of $1.8 billion in pre-tax for the last 3 quarters of 2022 and a break-even 1q 2023.

on tuesday, j p morgan held an airline investors' conference and this is what isom said:

So as we take a look at what that demand translates into, it’s been profitability. So for American, again, at the time that Doug was here last year, we were about to talk about first quarter results that produced a loss of $1.9 billion, a huge sum of money, big hole to climb out of. But fortunately, revenue production and managing the airline well, it produced results over the course of the year where we were able to not just rebound but actually able to produce a pretax profit for the year, so, a really nice result. Small pre-tax profit but still something that

that resulted in that full year profitability.we are really proud of $2.4 billion in pre-tax profits over the last three quarters

ok...so, isom said $2.4 billion in pre-tax profits for the last 3 quarters of 2022. excellent. if so, an additional $60 million in the kitty - bumps up the clean average to $8k per, for 30,000 assoc. employees. this is not the distribution formula, but it gives us an idea of what is to come.

could get better...aa forecast for 1q 2023 jetfuel:

ok. iata tells us this:It expects that cost to come down to somewhere between $3.33 and $3.38 per gallon as it heads into its first quarter of 2023.

Recent jet fuel price developments

DATE INDEX 10 Mar 298.7 3 Mar 316.9 24 Feb 308.5 17 Feb 292.6

jet fuel has been lower in the past month than forecasted - albeit, jan was higher, if i remember correctly. oil went down significantly the past few days due to the banking issues and will likely be lower the rest of march.

what i'm getting at is if isom's $2.4 billion in pre-tax profits is correct and aa makes a humble $101 million pre-tax profit in 1 quarter 2023, then the kitty doubles, from 10% of all pre-tax profits to 20%.

weaasles, i throw bags for a living. use your union connections to verify this scenario.

it could get much better than my optimistic prediction.

Last edited: